Taxes

Latest Taxes News

9 Common Tax Mistakes and How to Avoid Them

The more money you make, the higher your tax liability could be. And making a mistake in your filing can…

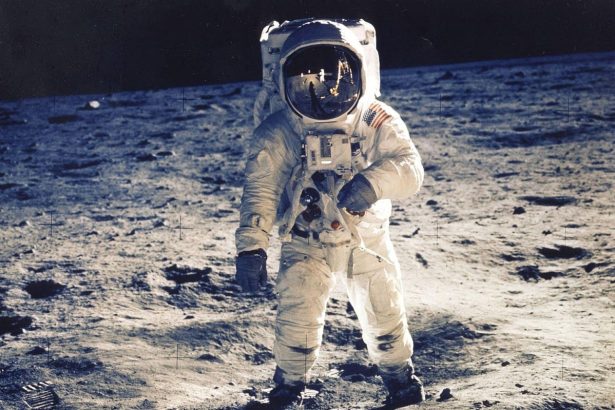

New Laws And Budget Proposals—Including One That’s Out Of This World

This is a published version of our weekly Forbes Tax Breaks newsletter. You can sign-up to get Tax Breaks in…

Understanding Form 8606 for IRA Taxes

If you use an IRA to save for retirement, IRS Form 8606 might be an important part of tax season.…

What Is Net Investment Income and How Is It Taxed?

Net investment income (NII) is defined as the profit gained from investments after deducting certain related expenses. This includes various…

The Complicated Process Of Bonding Projects To The Hydrogen Tax Credits

With apologies to Henry Cavendish, producing hydrogen in the lab was probably less fraught than producing final rules to implement…

How to Report a Backdoor Roth IRA With Form 8606

A backdoor Roth IRA typically offers high-income earners a workaround to contribute directly to a Roth IRA when their earnings…

IRS Whistleblower Awards — The New New And The New Form 211

The IRS Whistleblower Office has been the focus of a significant reform effort – seeking to make the award program…

How to Set Up a Payment Plan for Taxes You Owe

When an individual or business owes taxes to the Internal Revenue Service (IRS), settling the entire amount in a single…

Former IRS Crime Chief Finds New Home At Fintech Firm Chainalysis

The former Chief of IRS-Criminal Investigation, Jim Lee, has found a new home. Lee has announced that he was joining…

What Is a Gift Loan and How Does It Work?

A gift loan is essentially a loan with an interest rate well below the market average, or even no interest…