Taxes

Latest Taxes News

What Is a Gift Loan and How Does It Work?

A gift loan is essentially a loan with an interest rate well below the market average, or even no interest…

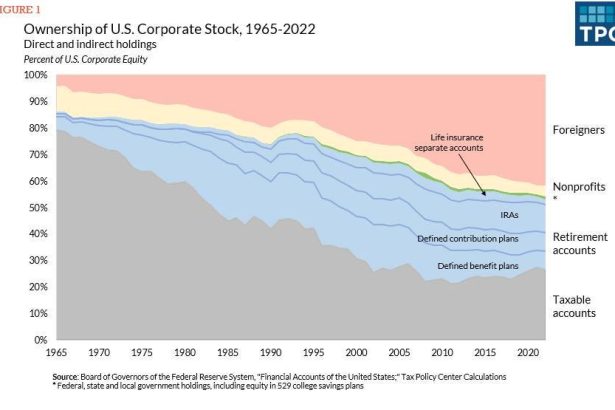

Who’s Left To Tax? Grappling With A Dwindling Shareholder Tax Base

Foreign investors, retirement accounts, and other tax-exempt entities now dominate US stock ownership. This shift has important implications for understanding…

1031 Exchange Rules in California

Selling an underperforming asset and buying a similarly priced, more promising investment is a logical business move – but what…

The SEC’s Final Climate Disclosure Rules: Simpler But Disputed

Tax Notes contributing editor Nana Ama Sarfo discusses the SEC’s recently released carbon pricing disclosure rules and their reception from…

What Are the Imputed Interest Tax Rules?

Imputed interest rules can turn even a simple act of generosity into a taxable event. This IRS regulation requires interest…

Remembering Daniel Kahneman, The Psychologist Who Upended Economics

Perhaps the two most influential economics thinkers of the past half-century were not economists at all. Psychologists Amos Tversky, who…

How to Avoid Overpaying Your Taxes

Getting a tax refund can seem like a financial windfall, but it means you’ve overpaid your taxes and given the…

Honey, I Shrunk The Tax Base: The Decline In Taxable Shareholders

Robert Goulder, Steve Rosenthal of the Urban-Brookings Tax Policy Center, and Livia Mucciolo discuss updated data from the policy center…

I’m Selling My House and Netting $480k. Can I Avoid Taxes While Downsizing for Retirement?

In most cases, when selling your primary residence you can exclude $500,000 of the gain if you file as a…

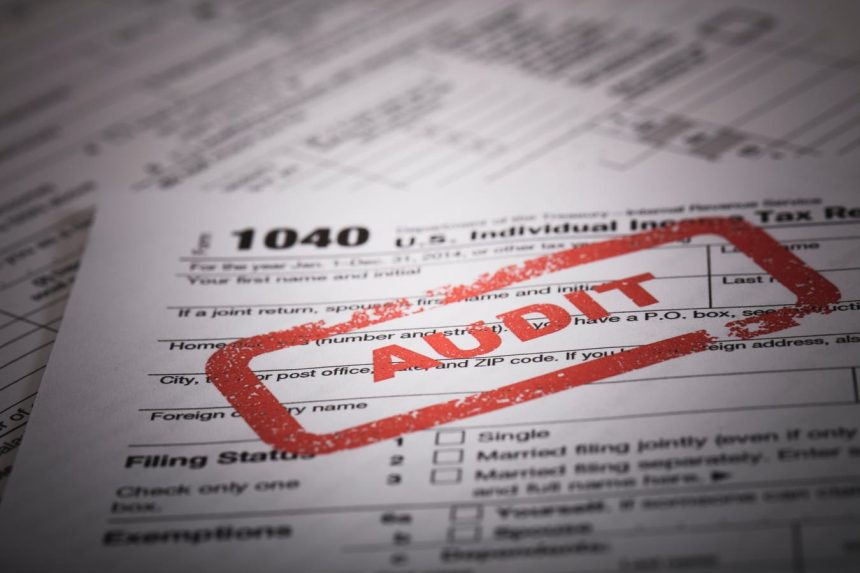

IRS Issues Proposed Regulations On The New Company Stock Buyback Tax

Congress created a new section of the tax code as part of the Inflation Reduction Act of 2022. Section 4501…