Taxes

Latest Taxes News

Treasury Secretary Yellen Indicates U.S. Will Not Support Global Billionaire Tax

The world’s ultra-rich should pay more in taxes. That’s the crux of a proposal by some members of the G20—and…

Don’t Roll Over RMDs To Other Retirement Accounts

Some retirees continue to make a key mistake with required minimum distributions, and that could cost them a lot of…

How Capital Gains Tax on Home Sales Works

If you sell your home for a profit, the IRS considers this a taxable capital gain. This rule applies to…

Biden’s Tariffs Conflict With His Environmental Goals

Slowing climate change has been a signature issue for President Joe Biden. But Biden also has been an ardent booster…

What Are the Tax Consequences of Inheriting a CD?

If you inherit or plan to bequeath a certificate of deposit (CD) as part of your estate, there may be…

IRS Extends Free File Program Through 2029, While Direct File Future Remains Uncertain

The IRS will extend the Free File program through October 2029, following an agreement to continue making free private-sector tax…

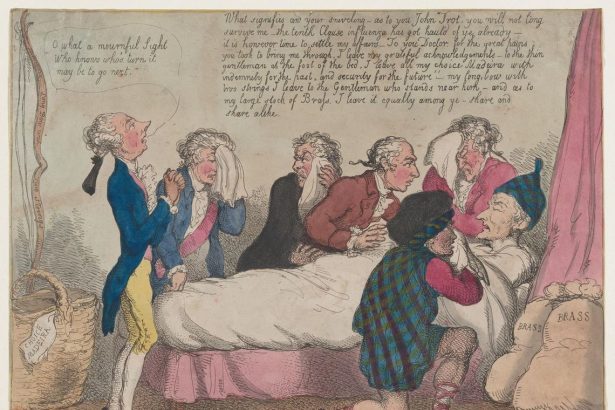

In Terrorem Clauses In Estate Planning

Disinheriting a child or family member from one’s estate plan can be one of the most difficult and often heartbreaking…

What’s Next For ERC Refund Claims Pending With The IRS?

The latest IRS data shows that it had 1,057,000 unprocessed Forms 941-X as of December 9, 2023. Most of those…

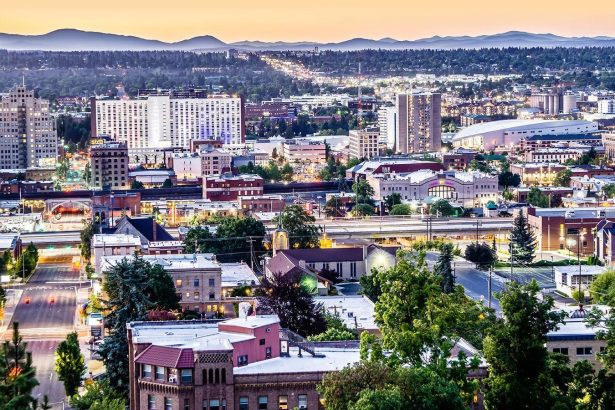

This Pandemic Boom Town Is Also A Surprisingly Wonderful Place To Retire

Remote workers and retirees alike have flocked to scenic Spokane, driving up home prices. But the city is working through…

When It Comes To Tax, May The Odds Be Ever In Your Favor

This is a published version of our weekly Forbes Tax Breaks newsletter. You can sign-up to get Tax Breaks in…