Taxes

Latest Taxes News

I’m Selling My House to Downsize for Retirement, and I’ll Net $620k. Do I Have to Pay Capital Gains Taxes?

When you sell your primary home, the IRS allows you to exclude a significant portion of the profit from your…

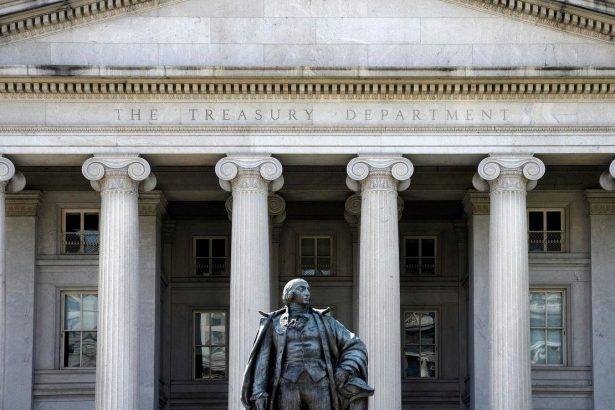

Government Files Notice Of Appeal After Corporate Transparency Act Deemed Unconstitutional

(Author’s Note: Edited to reflect Statement from the Treasury.) You knew it was coming: the U.S. Department of Justice and…

How to Avoid Prohibited Transactions With Your Self-Directed IRA

A self-directed IRA is a retirement savings plan that allows you to decide what investments will be made. These accounts…

Navigating The Corporate Transparency Act

Christine Green of Steptoe & Johnson PLLC discusses the Corporate Transparency Act and the recent litigation regarding its constitutionality. This…

DOJ Alleges Decades-Long Tax Scheme To Hide Foreign Assets From IRS

On March 11, 2024, the Department of Justice (DOJ) announced that a Florida man had been arrested for an alleged…

How to Receive Charitable Tax Deductions

Every year, charitable individuals and households make one saying a reality when they make a donation to nonprofits: It’s better…

Don’t Skip The IRS ‘Yes Or No’ Crypto Tax Question On 2023 Tax Returns

There is a lot of talk about crypto investors and tax compliance, but a yes or no question can be…

Who Is Eligible for the Earned Income Tax Credit (EITC)?

The earned income tax credit can provide substantial financial benefits for low-income working individuals and families, reducing taxes by hundreds…

Many Taxpayer Assistance Centers Provide Saturday Service

In addition to reopening many Taxpayer Assistance Centers and providing pop-up style service to taxpayers and tax professionals in rural…

My Dad Left Me $450k in an IRA, But I’m in the 32% Tax Bracket. How Should I Structure My Withdrawals?

There are a couple of different sets of rules around inherited IRAs and you’re subject to theleast flexible. While there…