Taxes

Latest Taxes News

I Worked Two Jobs in 2023. Can I Get a Tax Credit for Paying Too Much in Payroll Taxes?

If you paid Uncle Sam more than his fair share in payroll taxes in 2023, you may be owed a…

Ruling That Corporate Transparency Act Is Unconstitutional Could Benefit 65,000 Businesses—Or More

Days after an Alabama U.S. District Court judge ruled the Corporate Transparency Act—sometimes called the CTA—unconstitutional, businesses and their advisors…

Do I Have to Worry About Taxes if I Loan a Family Member $45,000?

It’s common for family members to lend money amongst themselves, and many choose to charge less than market interest rates…

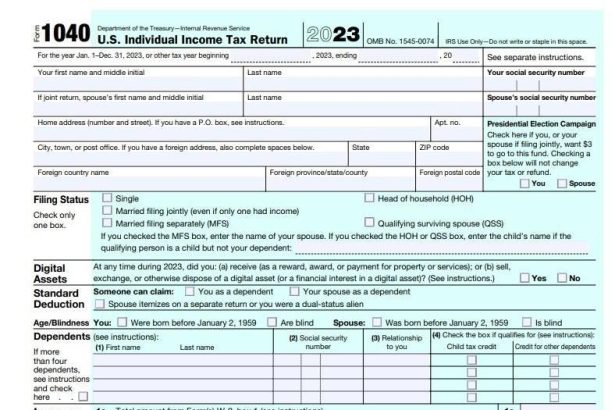

Understanding Your Form 1040

Top tax professionals will tell you that effective tax planning needs to be proactive, not reactive. The best tax planning…

Tax Credits You Can Use to Reduce Your 2024 Taxes

Tax season has arrived, and when it comes to preparing your return remember this: deductions are good, but tax credits are better.Anyone…

The IRS Improves Its ‘Where’s My Refund’ Tool

The IRS has made improvements to its refund tracking tool that should help taxpayers better understand the status of their…

What States Have a Flat Income Tax?

While the federal government applies a consistent tax system to every citizen, states have tax rates they set independently from…

The Essential Tax Guide For Last Minute Filers

Tax forms, changes, deadlines and refunds. Whether you’re starting or finishing your 2023 1040, we’ve got tips to see you…

Tax Deferred vs. Tax Exempt Retirement Accounts

The most common form of retirement account is tax-deferred. This refers to portfolios which allow untaxed contributions and gains during…

How to Make a Charitable Gift From Your IRA

Each year, you can make a tax-free charitable gift from your IRA or certain other pre-tax retirement account. This is…