Top tax professionals will tell you that effective tax planning needs to be proactive, not reactive. The best tax planning needs to happen all year long, not at the end of the year or (worse) at tax filing time.

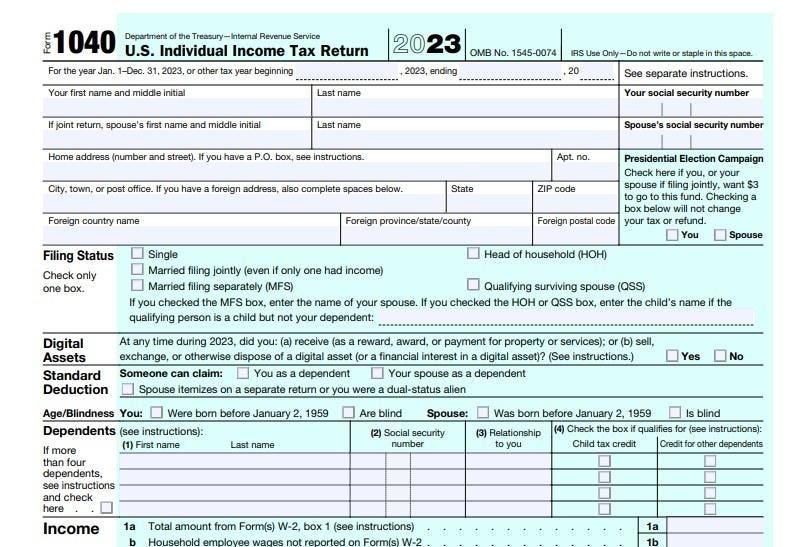

Timing aside, effective tax planning requires an understanding of Form 1040. When you understand your Form 1040, you not only can you make smart tax moves throughout the year, but you can also understand why they are smart tax moves.

Adjusted Gross Income

Possibly the most important line on your Form 1040 is the line that reports your adjusted gross income. For 2023, AGI is reported on Form 1040, Line 11. It includes all taxable items of income including those taxed at preferential rates (for example, capital gains). This line is important because many tax benefits, such as education credits, are phased out based on your AGI amount.

AGI is what lenders (especially mortgage lenders) look at when evaluating loan applications. It’s essential for taxpayers to understand what their AGI is and equally important to understand items that can adjust that number up or down.

Other Income And Above-The-Line Adjustments

Schedule 1 of Form 1040 is where adjustments to AGI are made. Part I of Schedule 1 includes a list of the most common types of other income that can increase a taxpayer’s AGI. These items flow to Line 8 of Form 1040.

Certain above-the-line adjustments, however, decrease AGI. Technically speaking, these adjustments are not deductions—their effect on the amount of tax owed is the same, but their effect on AGI is not.

For example, if reducing your AGI will put you under the threshold for repaying the advanced premium tax credit (the subsidized part of marketplace healthcare coverage) then recognizing when you may have items that will adjust your AGI is essential.

Part II of Form 1040, Schedule 1 includes a list of income adjustments. Some of the most common above-the-line adjustments to income are for educator expenses, student loan interest, and the deductible part of self-employment tax (a self-employed person’s contributions to Medicare and Social Security, more on that later). The amounts from Part II are added together and flow to Line 10 of Form 1040.

Taxable Income

Taxpayers concerned about their tax bracket (or marginal tax rate, more on that below) often look at their AGI and panic. Panic prevention is why it’s important to understand the difference between AGI and taxable income. Taxable income is the amount of income on which tax is paid.

At its most basic level, taxable income is AGI minus either the standard deduction for your filing status (single, married filing jointly, married filing separately, or head of household) or your itemized deductions. And that’s why it’s also important to understand the difference between using the standard deduction or itemizing deductions.

The Standard Deduction Vs. Itemized Deductions

The Tax Cuts and Jobs Act roughly doubled the standard deduction for all filing statuses through the end of 2025. Consequently, the number of people who benefit from itemizing their deductions decreased dramatically starting in 2017.

It is not a deep financial failing to take the standard deduction if that is where you realize the most benefit. For the 2023 tax year, the standard deductions are—

· Single & Married Filing Separately — $13,850

· Married Filing Jointly — $27,700

· Head of Household — $20,800

Married taxpayers get an additional $1,500 for each person who is age 65 and/or blind. Single taxpayers and those who file head of household get an additional $1,850 for being age 65 and/or blind. Even using the base deductions married taxpayers who file a joint return would have to have more than $27,700 in itemized deductions to get any tax benefit over taking the standard deduction. That’s a lot of deductions.

Tax Tips

Tax tips often focus on a few well-known deductions, but they also often omit the fine print.

For example, qualifying medical expenses can increase itemized deductions, but the first 7.5% of your deductions based on your AGI (with some additional adjustments) are not deductible. The higher the income, the higher the threshold above which medical expenses become deductible. Often, medical expenses have to border on the catastrophic before upper-middle-income taxpayers can deduct them. And, of course, the itemized deduction for state and local tax (or SALT) is capped at $10,000 per return.

Charitable deductions can be itemized but are typically capped at a percentage of AGI. Noncash charitable contributions can be included but, if they exceed $500, additional substantiation is required. Additionally, noncash contributions of more than $5,000 per item or group of similar items (furniture, for example) require a qualified appraisal.

The Tax Cuts and Jobs Act also eliminated the itemized deductions for unreimbursed employee expenses and other “miscellaneous itemized deductions” through the 2025 tax year.

It doesn’t hurt to review a list of tax tips, but it is equally important to be aware that not everyone will be able to benefit from them.

Deduction Or Tax Credit

Often taxpayers worry about missing available tax deductions. Deductions, if you are itemizing them, reduce taxable income. You are spending a dollar to save pennies.

For example, taxpayers in the 12% bracket are spending a dollar (on medical, on charity, on state and local taxes) to save 12 cents in taxes. That’s not good math unless you were planning on spending that money anyway. Spend the money you would normally spend and take every deduction that is legally available to you. But don’t spend money you wouldn’t otherwise consider spending just to get a tax deduction.

Tax credits, on the other hand, are a dollar-for-dollar reduction in tax. Often, to receive a credit, a taxpayer must have tax to which it can be applied. If the taxpayer’s income is so low that no tax is owed, the person does not receive the benefit of the credit. Some unused credits carry forward, while others do not. Whether or not they carry forward, tax credits that can only be applied against tax due are called nonrefundable credits.

Other tax credits are refundable. Even if a taxpayer does not owe any tax, the person can receive the credit. The earned income tax credit, the child tax credit, and the American opportunity tax credit are examples of refundable credits.

Taxpayers who use a professional to prepare their returns should be aware that there are heightened due diligence requirements for professionals claiming refundable credits for their clients. Tax professionals are expected to ask a lot of questions (and document the questions and the answers) for taxpayers claiming these credits. The increased due diligence can also increase the price of return preparation.

Marginal And Effective Tax Rates

Your marginal tax rate is what is often called your tax bracket. Current tax brackets are 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Many taxpayers believe that moving to a new marginal rate means that all of their income is taxed at that rate. That is not how it works.

Your tax bracket applies progressively to your taxable (not your gross) income. At its simplest level, this means that you subtract your itemized or standard deduction from your AGI to arrive at your taxable income. The marginal rates are then applied to this taxable income in order: The first $11,000 of income ($22,000 for joint filers) is taxed at 10%; taxable income of $11,001 up to $44,725 is taxed at 12%; the bit from $44,726 to $95,375 is taxed at 22% and so on. Marginal rates are adjusted every year.

Your effective tax rate is the rate you actually pay on your income. If you don’t have much income in the 24% bracket, for example, it’s possible that your effective rate could be 22%.

Your effective rate could also be lower than your marginal rate because some income is taxed as ordinary while other income is taxed at lower capital gains rates. Capital gains rates are the reason why Warren Buffett has said that he pays a lower tax rate than his secretary. Most of his income comes from his money making him more money. That kind of income is taxed at capital gains rates. Earned income, however, is taxed as ordinary income and is subject to the marginal rates as described above.

Income Tax And Self-Employment Tax

It is possible for low-income, self-employed taxpayers to pay no income tax but still have a balance due on their Form 1040. Often, for self-employed individuals, their SE tax (Social Security and Medicare) is a larger part of the balance due on Form 1040 than income tax.

Why? First, self-employed taxpayers must pay both the employer and the employee parts of SE tax. Employees getting a Form W-2 have their employee contributions withheld from their paychecks and their employer pays the other half. Second, many self-employed taxpayers don’t pay attention to their quarterly profits and make the necessary estimated payments.

For example, consider a taxpayer who makes $5,000 per quarter in profit (gross income minus expenses). SE tax is roughly 15% or $750 per quarter for this taxpayer. That’s $3,000 in SE tax for the year.

Next, assume the taxpayer has no other income and takes the standard deduction. The taxpayer is allowed to reduce the $20,000 AGI by the employer part of the SE tax ($20,000 minus $1,500 is $18,500 in AGI). Subtracting the standard deduction of $12,550 leaves the taxpayer with $5,950 in taxable income. The tax on that would be $595. That’s less than one quarter’s worth of SE tax!

This taxpayer’s balance due, assuming no estimated payments were made, would be $3,595. The example illustrates why self-employed taxpayers (or those with side hustles) who don’t feel like they are earning much money should pay attention to their quarterly profits and plan at least for the effect of SE tax on their Form 1040 results by making quarterly estimated payments as appropriate.

Income tax should also be factored into the quarterly estimates as profit increases or if the individual taxpayer or the taxpayer’s household has other income.

Conclusion

This article provides a basic overview of the mechanics of Form 1040. The Internal Revenue Code is a complex mass of moving parts. It’s similar to the software that runs the IRS. It’s big and many pieces are interrelated, but others aren’t or the relationships aren’t always clear.

This summary is not a substitute for the advice of a qualified, competent tax professional, but it may help you to understand the why factor of tax advice you may hear or read. This may help you deduce whether or not a deduction or credit applies would be beneficial in your specific situation.

Finally, understanding the Form 1040 mechanics may help you to understand the terms used by your tax professional, which also will help you understand the information on your tax return.

Read the full article here