Study Summary

- 82% have noticed inflation’s impact on groceries and 66% have noticed higher prices at the gas pump.

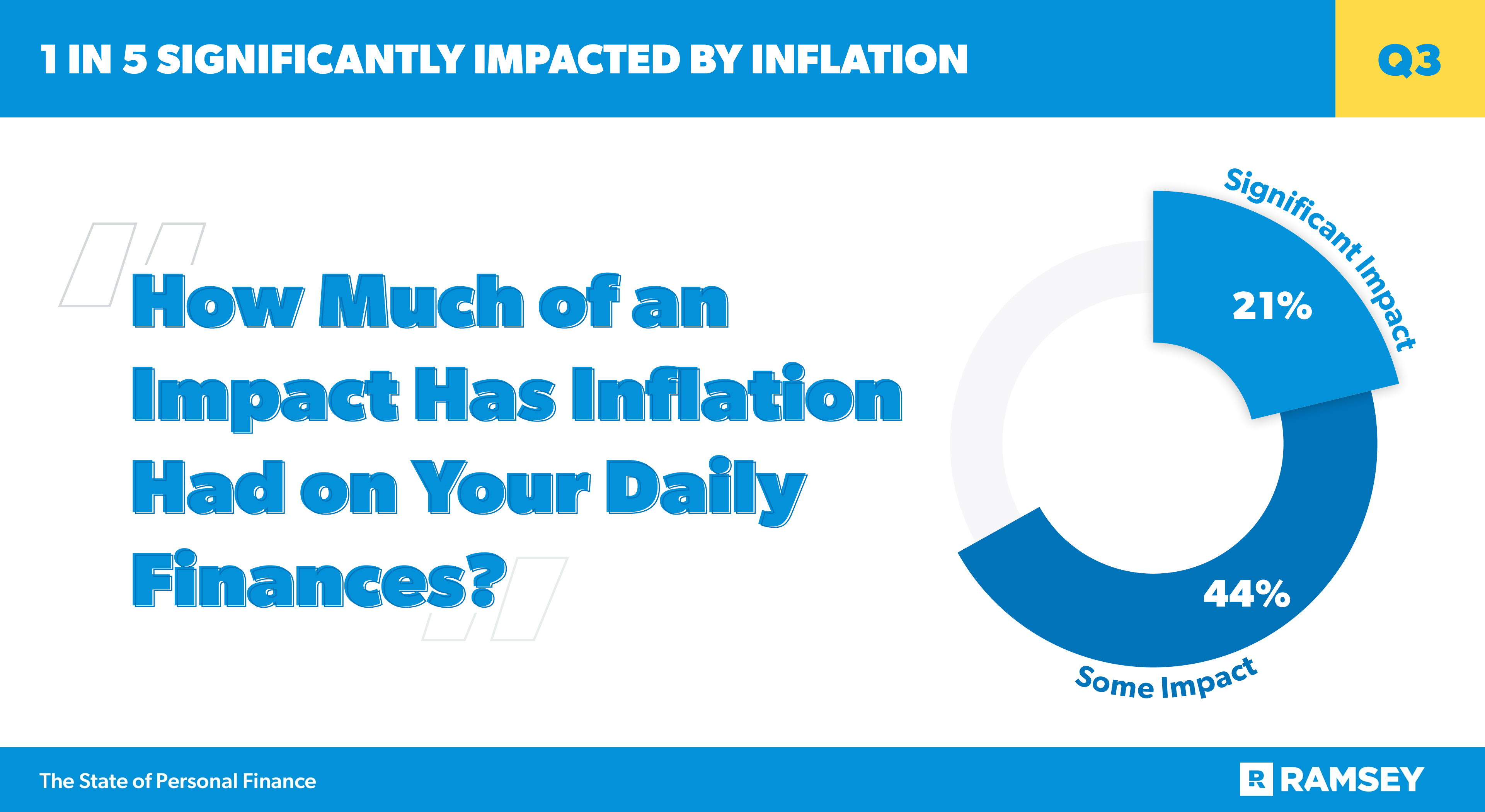

- 21% say inflation has had a significant impact on their day-to-day finances.

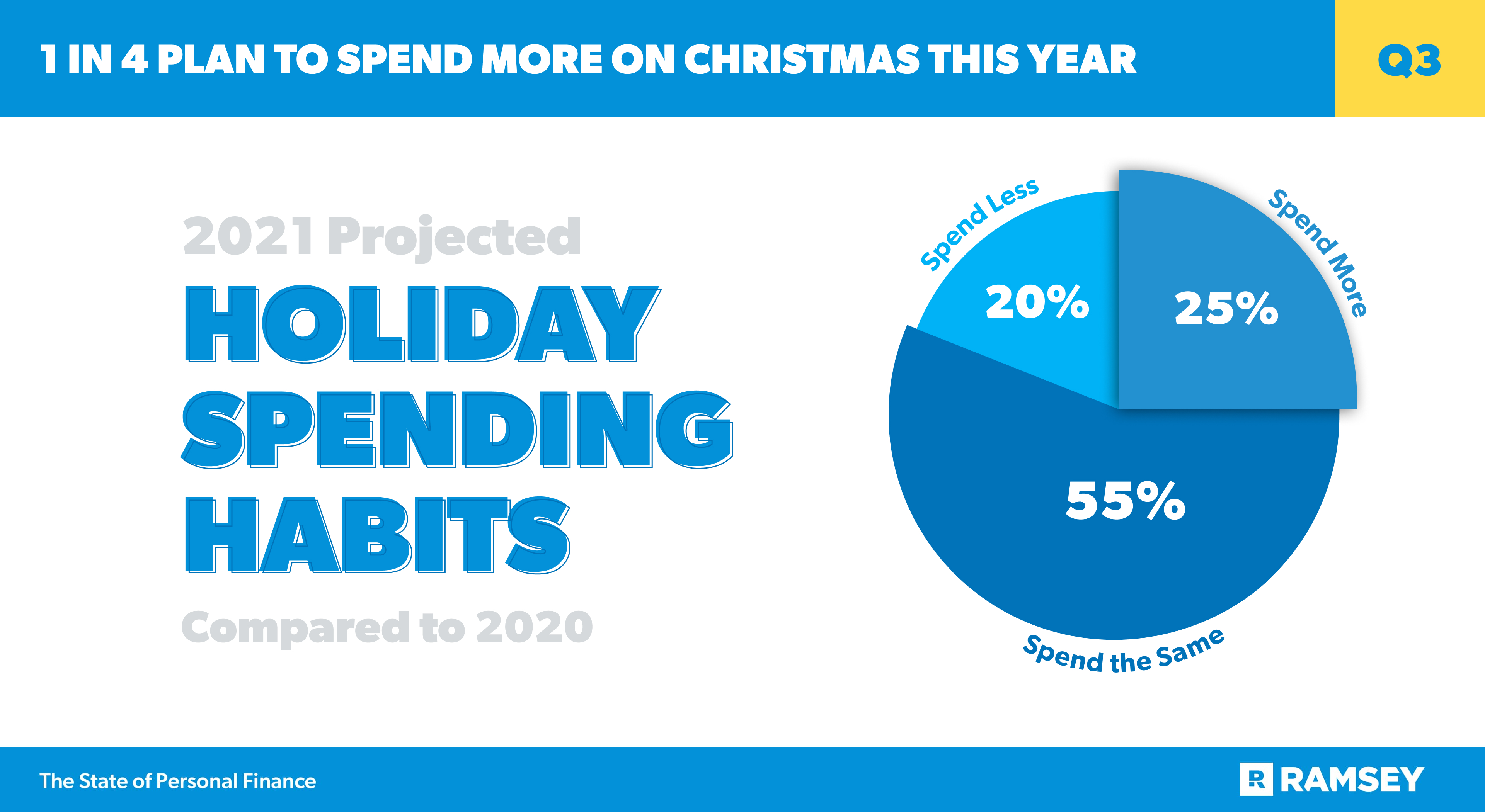

- On average, those planning to spend on Christmas and the holidays are planning to spend $641.

- One-quarter plan to spend more during the holidays than they did last year.

- More than half of millennials (55%) plan to shop on Black Friday this year and 44% plan to shop on Cyber Monday.

- Nearly half of Black Friday/Cyber Monday shoppers plan to spend money on non-gifts.

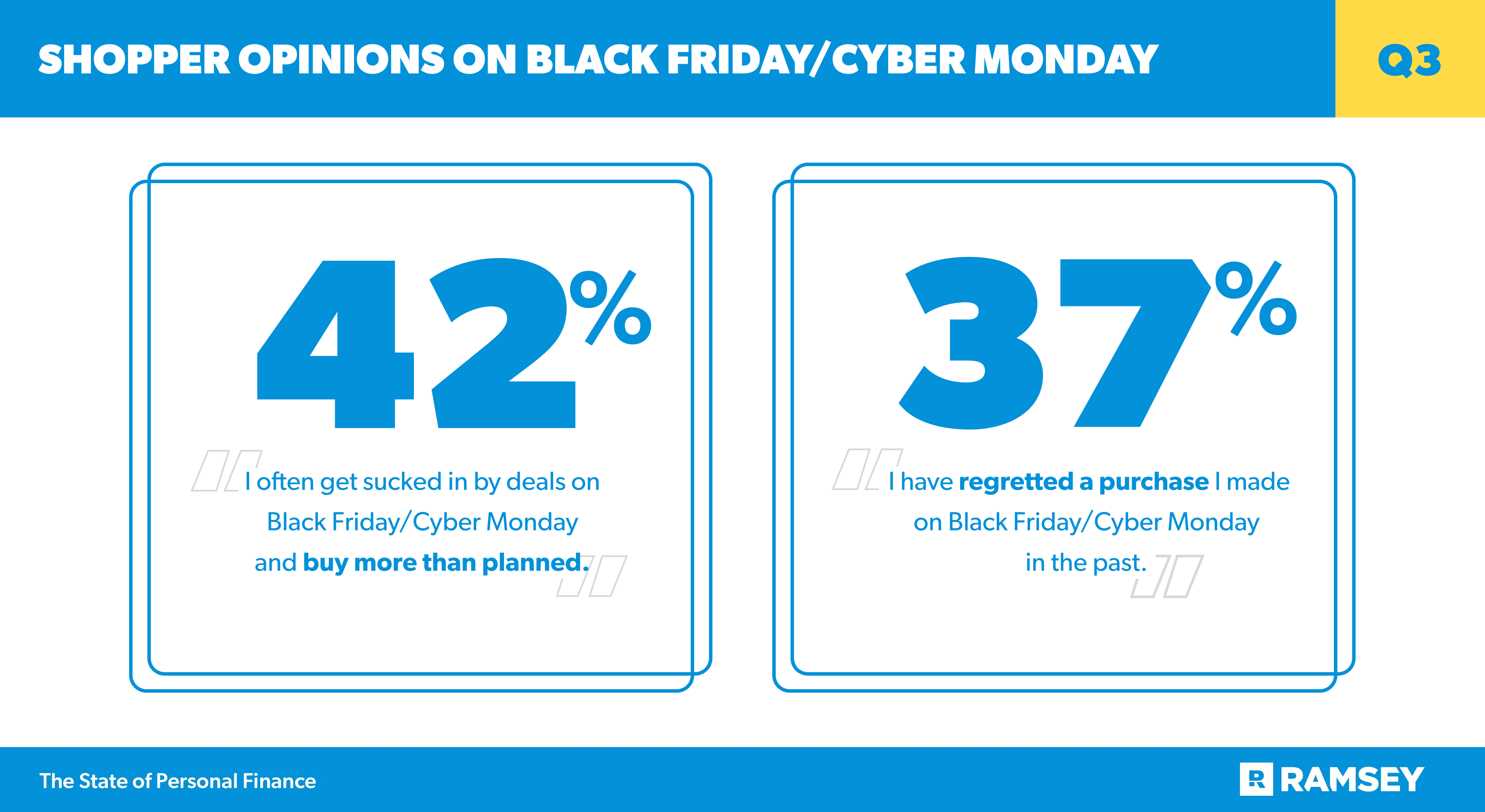

- 42% of Black Friday/Cyber Monday shoppers admit they often get sucked in by the deals and end up buying more than they originally planned.

- 37% regret purchases they’ve made on Black Friday/Cyber Monday in the past.

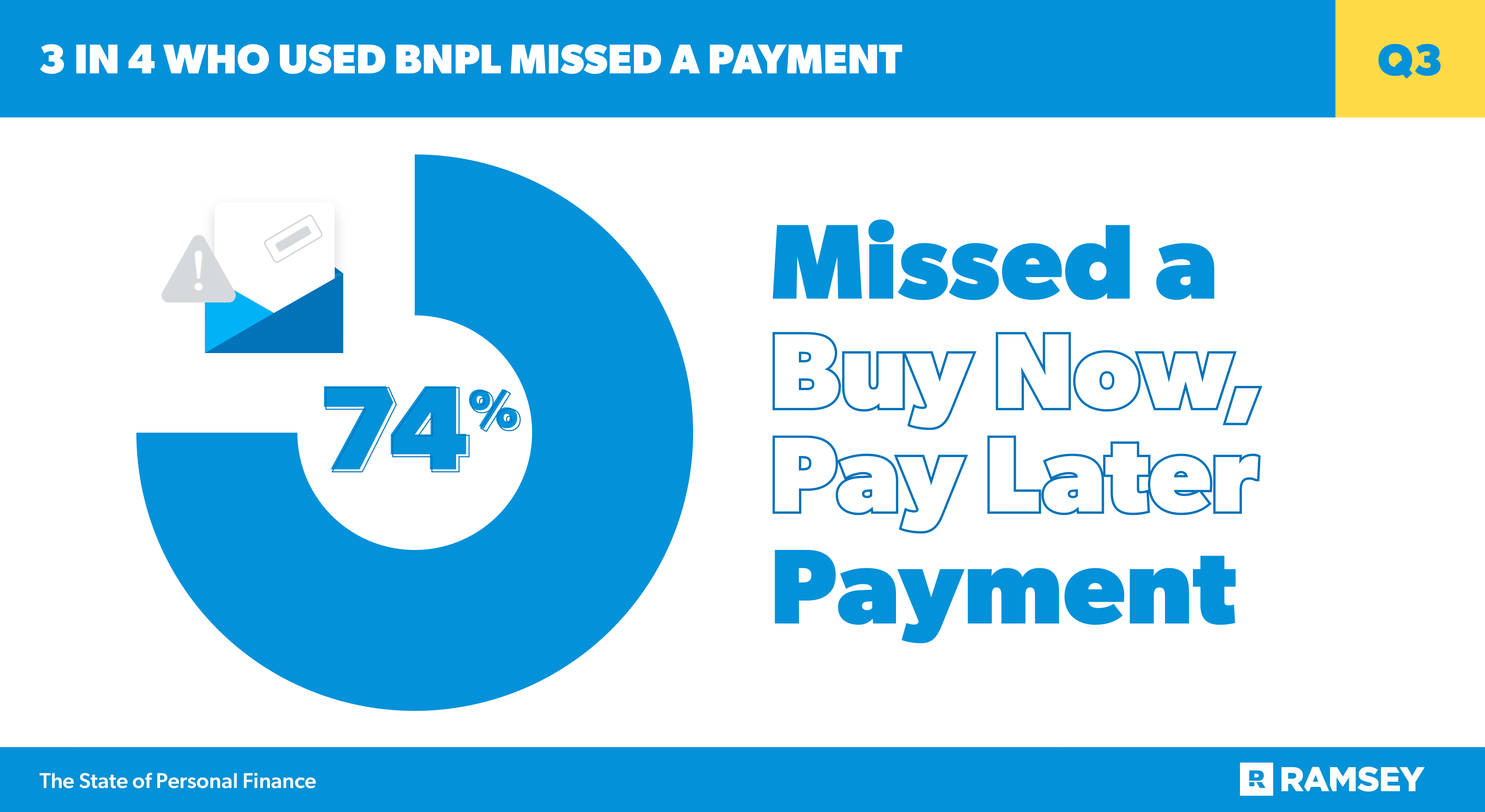

- 22% have used a buy now, pay later service in the last three months, and three-quarters of those have missed a payment.

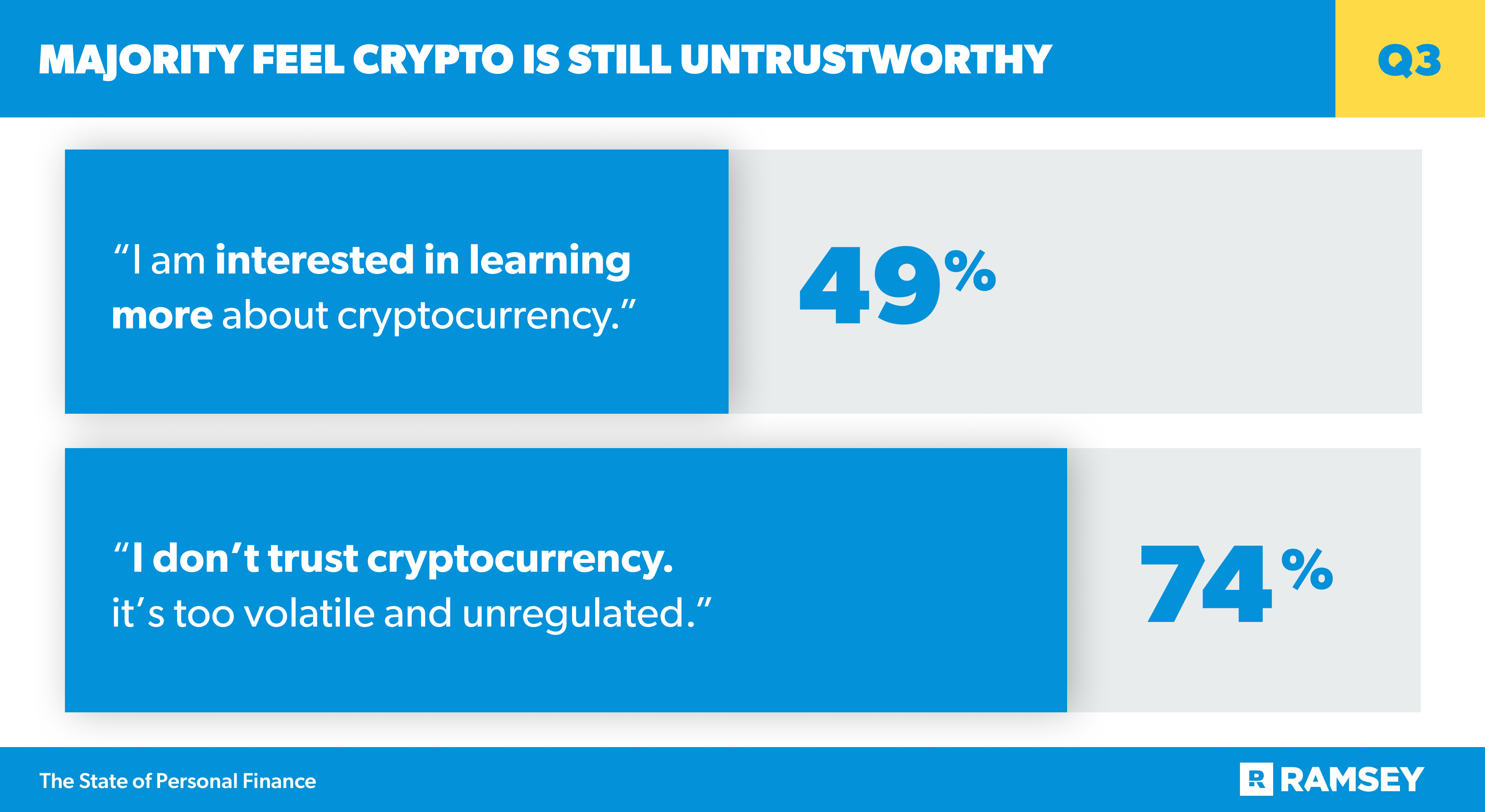

- Half are interested in learning more about cryptocurrency, but 74% don’t trust it and think it’s too volatile and unregulated.

Downloads

Have questions about this study? Email us or visit our newsroom for more information.

The year is winding down, but the busy holiday shopping season is still ahead. The latest quarterly release of The State of Personal Finance study from Ramsey Solutions digs into the pain consumers are feeling from rising inflation and what that means for their upcoming holiday spending. The study also explores shoppers’ plans for big sales days like Black Friday and Cyber Monday and how their attitude around these events and their “can’t miss” deals may be shifting.

We’ll also take a look at how Americans are engaging with new products and services in the financial landscape like buy now, pay later services and cryptocurrency.

Consumers Feel the Pain of Inflation in Their Pocketbooks

Prices for consumer goods have been rising throughout the year. Americans have faced inflation as high as 5% in 2021, and it’s not going unnoticed. The majority of Americans (79%) say their money doesn’t seem to go as far as it used to, and eight in 10 have experienced higher prices on the things they normally buy in the last three months. Consumers are seeing these increases the most on everyday items like groceries (82%) and gas (66%). But inflation’s reach goes beyond that with nearly half (48%) of consumers seeing higher prices on household goods, 38% on clothing, and 19% on furniture.

Those rising prices are starting to hit people in the wallet. Two-thirds of Americans say inflation has had an impact on their day-to-day finances, with one in five experiencing a significant impact. And those in debt fared even worse. People with consumer debt (28%) were more than twice as likely to say inflation has had a significant impact on their day-to-day finances compared to those who are consumer debt-free (13%). Inflated prices for these everyday goods are hitting those who live paycheck to paycheck particularly hard, with nearly one-third (31%) saying inflation has had a significant impact on their day-to-day finances.

With consumer prices on the rise across the board, consumers will have to increase their income or tighten their budgets. Many will face hard choices as we head into the end of the year and the busy holiday shopping season.

One-Quarter Plan to Spend More on the Holidays This Year

With the year’s biggest shopping season right around the corner, many Americans are already making their holiday spending plans. Four in 10 expect to spend on Thanksgiving, 68% are planning to spend on Christmas, and one in five will spend on New Year’s Eve. On average, they’re planning to spend $216 on Thanksgiving and $641 on Christmas. For Thanksgiving, the top expenses are decorations and gifts. While at Christmas, not surprisingly, gifts are the top expense, with decorations and candy rounding out the top spending categories.

And after a pared-down holiday season last year, one in five say they’ll spend more on Thanksgiving than they did last year, while 25% are planning to spend more on Christmas this year than last year. With the holiday shopping season starting earlier and earlier every year, many shoppers are getting an early start on holiday budgeting as well. More than a third (35%) say they start saving for their Christmas or holiday spending by September. However, on the other extreme, nearly three in 10 (29%) don’t plan ahead at all for their holiday spending.

Technology Is the Top Category for Black Friday Deals, but the Majority Don’t Think Those Sales Are Unique

Americans, especially millennials, are planning to take advantage of Black Friday and Cyber Monday deals this year. Forty-two percent (42%) say they will shop on Black Friday, 35% will shop on Cyber Monday, and 13% will shop on Small Business Saturday. Millennials are even more likely to shop on these special shopping days, with more than half (55%) saying they’ll shop on Black Friday, 44% on Cyber Monday, and 16% on Small Business Saturday.

Shoppers will load up their carts with more than holiday gifts. Many are planning to buy things they and their family need and want as well. In fact, while 71% plan to buy gifts for other people on Black Friday and Cyber Monday, nearly half (48%) say they’ll buy items for themselves or for their family that they need, while nearly a quarter (22%) plan to buy items for themselves or their family that they want (non-gifts).

Technology tops most shoppers’ Black Friday and Cyber Monday shopping lists. More than half (52%) say they’ll shop for technology like computers, phones and tablets this year on Black Friday and Cyber Monday. Forty-eight percent (48%) plan to buy clothing, 36% will look for deals on toys, 27% say they’ll buy appliances, and 23% plan to buy furniture. Millennials especially are planning to shop for upgrades for their homes this holiday season. Thirty-seven percent (37%) of millennials shopping on Black Friday and Cyber Monday will look for deals on appliances, while 31% plan to buy furniture.

But while Black Friday and Cyber Monday are best known for their deeply discounted items and crazy sales, those offers aren’t always best for shoppers and their budgets. In fact, the research shows that many let the frenzy of those shopping holidays get away from them. Forty-two percent (42%) of Black Friday and Cyber Monday shoppers admit that they often get sucked in by the deals and end up buying more than they originally planned. Another 37% say they regret purchases they’ve made on Black Friday or Cyber Monday in the past. Consumers need to make a holiday shopping plan and stick to it to avoid money regrets as they head into the season.

The research also shows that the power of these holiday shopping events may be decreasing in the eyes of consumers. Six in 10 feel like Black Friday and Cyber Monday deals aren’t any better than other sales throughout the year. Educated consumers are beginning to see through some of the gimmicks of these big holiday sales promotions and make smarter choices with their finances.

The Majority Who “Buy Now” Don’t Always “Pay Later”

Another shift in consumer habits shows that buy now, pay later (BNPL) services are becoming more common. Nearly one in four online shoppers have used a BNPL payment service like AfterPay, Affirm or Klarna in the last three months. BNPL services allow shoppers to split the cost of an item into several payments made over time. But the data shows that the majority of those who use these services have missed a payment. Of the 22% who used a buy now, pay later service in the last 90 days, 74% have missed a payment in their payment plan.

Younger shoppers are both more likely to use these payment options and more likely to miss payments. In the last three months, 30% of Gen Z and 42% of millennials have used BNPL services, compared to only 19% of Gen X and 5% of boomers. And 88% of Gen Z and 78% of millennials have missed payments in their BNPL payment plan, compared to 69% of Gen X and 50% of boomers.

Not only are younger consumers more engaged with this newer form of payment, but so are more affluent households. More than one-third (35%) of households making more than $100,000 have used a BNPL service, compared to only 13% of households making less than $50,000 and 21% of households making $50,000–99,000. More affluent households were also more likely to miss payments, with 82% of those making more than $100,000 admitting to missing a payment in their BNPL payment plan, compared to 53% of households making under $50,000, and 68% of households making $50,000–99,000.

Many Are Curious About Cryptocurrency but Still Hesitant to Get Involved

The buzz around cryptocurrency continues to build, with more and more retailers accepting it as a form of payment. However, many Americans are still clueless about this complicated new market. Twenty-seven percent (27%) say they have no idea what cryptocurrency is, while only 14% say they have a very clear understanding of cryptocurrency.

Despite that, 22% have purchased cryptocurrency, with younger generations being more likely to embrace it. One-quarter (25%) of millennials say they have a very clear understanding of cryptocurrency, and 40% of millennials have purchased it. Higher income households are also more likely to have gotten involved with cryptocurrency. Thirty-six percent (36%) of households making more than $100,000 have purchased cryptocurrency, compared to 20% of households making $50,000–99,000 and only 13% of households making under $50,000.

Americans’ attitudes about cryptocurrency are mixed. They are interested in learning more and see cryptocurrency as part of the financial future. But they aren’t ready to get involved yet. Half (49%) say they’d like to learn more about cryptocurrency and 45% say cryptocurrency is the future of money and finances. But right now, even more express uncertainty. Eight in 10 say they are hesitant to put any of their money into cryptocurrency, and three in four say they don’t trust cryptocurrency because it’s too volatile and unregulated. Millennials (71%) were more likely to be interested in learning more about cryptocurrency, and two-thirds of millennials feel like cryptocurrency is the future of money and finances. And while millennials have a more positive outlook on cryptocurrency’s future, they are as hesitant as other generations to invest in it. Three-quarters (75%) of millennials, 75% of Gen X and 88% of boomers say they are hesitant to put any money into cryptocurrency. Sixty-nine percent (69%) of millennials, 68% of Gen X and 85% of boomers say they don’t trust cryptocurrency because it’s too volatile and unregulated.

Conclusion

With 2021 wrapping up, Americans are facing higher prices, and people who are in debt and living paycheck to paycheck are feeling the sting the most. Even so, most people are ready to celebrate the holidays and expect to spend more than they did last year. And while many shoppers are becoming skeptical of Black Friday and Cyber Monday deals, they will still make the most of these traditional shopping days to save on holiday gifts as well as wants and needs for their own families.

Buy now, pay later options, while they appear convenient on the surface, pose the same danger as any credit-based payment method, as evidenced by the high numbers of people who miss their BNPL payments. And finally, while most people agree cryptocurrency is here to stay, many are still too wary to invest their own money into such a volatile and unregulated option.

About the Study

The State of Personal Finance study is a quarterly research study conducted by Ramsey Solutions with 1,004 U.S. adults to gain an understanding of the personal finance behaviors and attitudes of Americans. The nationally representative sample was fielded September 29, 2021, to Wednesday October 6, 2021, using a third-party research panel.

Read the full article here