THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

When it comes to investing, many of us resort to traditional investments like stocks and bonds.

But there are many other options out there to invest in.

In this post, I walk you through 25 uncommon investment ideas that you might not have thought of.

They all offer their own range of potential returns and associated risks, but are great for individual investors looking for alternatives to the stock market.

25 Uncommon Investment Ideas

#1. Comic Books

Comic books are one of the most unique investment ideas people don’t think of.

This doesn’t mean that you should run out and buy a bunch of comic books and expect them to increase in value over time.

But if you can find older comics, say from 1985 or older, that are in great condition, chances are you can make money.

You can still buy newer comic books as well, it is just harder to earn a return on these since they are mass produced.

If limited editions or a significant issue is released, it can make sense to buy it and hold onto it.

Average Return To Expect

This is subjective because it all comes down to what someone is willing to pay for an issue.

With that said, you can easily see returns of 10% or more.

#2. Toys

Just like comic books, toys can be a great investment.

The key is to find rare or vintage items that have been discontinued and are no longer being manufactured.

These tend to hold their value better than newer items and can even increase in price over time.

For example, the original Star Wars figures are worth a lot of money today.

Be sure to do your research on what toys are currently in demand and could be worth investing in.

The easiest way to do this is to jump on eBay and search for various toys.

Finally, don’t discount current toys either.

You can find limited edition toys today and hold on to them for a few years and sell for a profit.

Or you can sell sooner when the market is hot.

Take for example Lego’s.

There is a huge demand of all kinds of Lego’s, so you can buy these sets and resell them quickly for a profit.

On the other hand, there are fads with toys.

Years ago, Beanie Babies were a hot toy and people were making crazy amounts of money selling them online.

But now there is very little demand and the prices came cratering back down.

Average Return To Expect

Again, this is subjective depending on the toy that you invest in.

However, if you find a rare or vintage toy that is no longer being manufactured, it can easily have a return of 20% or more.

#3. Sports Teams

While it is a dream of many to own a professional sports team, the reality is it is not possible.

With teams being valued in the billions of dollars, even owning a 1% minority stake is off limits.

But this doesn’t mean you can’t make your dream a reality.

You can invest in minor league teams instead.

Baseball and hockey teams are where there is the most value.

However, there is a lot of risk as well.

This is because many of these teams struggle to bring in fans and need to use debt to finance operations.

Average Return To Expect

On an annual basis, you can expect little to no return, around 1%.

But when you sell, this is where you can earn 20% or more on your money.

And while you wait to sell, you have access to other perks.

You can attend the games for free, have unlimited access to the stadium, even get to know the players on a personal level.

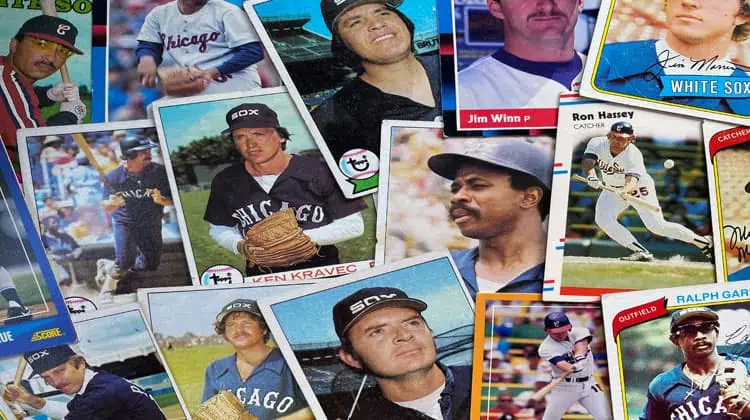

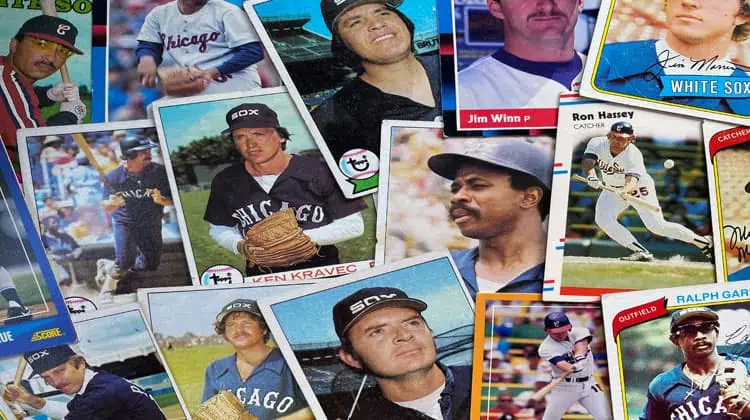

#4. Sports Memorabilia

Similar to sports teams, sports memorabilia can also be a great investment.

And I’m not just talking about baseball cards here.

Sports cards, jerseys, balls and other items can sell for big bucks.

But it is important to know what you are buying before jumping in.

For example, autographed baseballs from current players aren’t worth as much as those signed by Babe Ruth or Mickey Mantle.

But some of today’s stars could have their autographs be worth thousands of dollars in the future.

It is also important to buy memorabilia that isn’t mass produced.

If it is something that can be easily reproduced, it won’t have the same value down the road.

Finally, make sure you buy memorabilia from a reputable source.

You don’t want to end up with a fake item.

Average Return To Expect

This also varies depending on what you invest in, but typically you can expect a return of 20% or more.

Just make sure the memorabilia is from a player or team that is popular and in high demand.

#5. Military Collectibles

Another weird investment option is military history.

While not all artifacts from military history are considered valuable, there are items that are.

Specifically, items from World War II and the Civil War.

This is because these items are becoming harder to find as collectors snatch them up.

If you can find an item from either of these wars in great condition, it could be worth a lot of money.

Be sure to do your research on what is currently in demand before investing.

Average Return To Expect

Again, this is subjective and depends on the item that you invest in.

However, some items have sold for over six figures.

So if you find a rare piece that is in excellent condition, it could easily have a return of 20% or more.

#6. Music Royalties

If you are looking for a less risky investment or a way to diversify your investments, music royalties are a great investment opportunity.

This is because you are investing in something that will always have value.

Music will always be around and people will always want to listen to it.

Plus, as technology advances, the opportunities for music royalty growth increase.

You can invest in a music catalog, which is a collection of songs that are owned by an individual or company.

From there, you collect a royalty each time one of those songs is played.

The more popular the song, the higher the royalty payout will be.

You can even buy royalty streams of popular songs.

For example, you can pay a certain amount of money to earn 10% of the revenue for the next 10 years on “Bring Me To Life” by Evanescence.

Some royalty streams offer the revenue for life.

However, this investment does come with some risk.

You never know if a particular song will take off or not.

Also, the royalty payout can vary greatly from one song to another.

Average Return To Expect

This is difficult to estimate because it all comes down to how many times a particular song is played and the term of the royalty agreement.

However, if you invest in a catalog of songs and at least one becomes popular, you could see returns of 20% or more.

#7. Hurricane Options

Here is an investment option that I would call more of a bet than an investment because of the high degree of risk associated with it.

You can bet on where or if a hurricane will make landfall.

Prices for the options vary all the time.

These Hurricane Risk Landfall Options, or HuRLOs, trade on the Chicago Mercantile Exchange.

You can trade them up to one day before a hurricane makes landfall.

The biggest downside is that these investments are limited to investors with at least $5 million dollars of net worth.

Average Return To Expect

There are no published returns for these HuRLOs, so I can’t say with confidence the return you could expect to earn with this investment.

#8. Parking Spots

Parking spots are a hot commodity in most major cities.

This is because the availability of parking continues to decrease.

In some cases, people are willing to pay more for a parking spot than they are for an apartment.

As with any good investment, there is risk involved when purchasing a parking spot.

The spot could be taken by someone else, the city could start to charge for parking in the area, or the value of the spot could decrease.

However, if you are able to purchase a parking spot in a desirable location and hold on to it for a few years, you can see significant returns.

In some cases, people have been able to sell parking spots for double or even triple the amount they paid for them.

Average Return To Expect

It is difficult to estimate an average return as this depends on so many factors, such as location and time of purchase.

However, if you are able to hold onto a spot for a few years, you could see returns of 100% or more.

#9. Vintage Cars

Another of the alternative investments that has the potential for high returns is vintage cars.

The value of these cars increases over time as they become more and more rare.

In some cases, people have been able to sell vintage cars for millions of dollars.

And it isn’t limited to just vintage cars either.

There are cars from the 1980’s and 1990’s that have become popular with car enthusiasts as well.

Because of this, some of the models are selling for 50% or more than just a few years ago.

The keys here are to keep the car in excellent condition and to have low miles on it.

But even with this, there is still the chance that the car you think will appreciate in value only depreciates.

Average Return To Expect

Like toys and comic books mentioned earlier, the return you get will be based on the interest of other buyers.

This makes it hard to nail down returns for classic cars.

Overall you can expect 30% or more return on your investment.

#10. Fine Wine

Fine wine is another investment that has the potential to provide high returns.

The reason for this is because fine wine is a finite commodity.

There will only be so much of it made and, as time goes on, it becomes more and more rare.

This makes the price of fine wine go up over time.

In some cases, people have been able to sell fine wine for millions of dollars.

The key here is to buy wine that is in good condition and has been stored properly.

You also need to be aware of the vintage of the wine you are purchasing.

Some wines from earlier vintages are worth a lot more than wines from later vintages.

Average Return To Expect

Again, it is hard to estimate an average return as this will vary depending on the wine you purchase.

However, if you purchase wine that is in good condition and has been stored properly, you can expect a return of 50% or more.

#11. Fine Art

Art is another good idea to invest in that has the potential to provide high returns.

The reason for this is because art is a finite commodity.

There will only be so much of it made and, as time goes on, it becomes more and more rare.

This makes the price of art go up over time.

In some cases, people have been able to sell art for millions of dollars.

The key here is to buy art that is in good condition and has been stored properly.

You also need to be aware of the artist you are purchasing from.

Some artists are more popular than others and their art will sell for a higher price.

The easiest way to get started in the world of art investing is with a firm like Masterworks.

They allow you to own a percentage in high end artwork.

This allows you to invest a smaller amount of money and still enjoy the return on your money.

Average Return To Expect

Again, it is hard to estimate an average return as this will vary depending on the art you purchase.

However, if you purchase art that is in good condition and has been stored properly, you can expect a return of 15% or more.

#12. Luxury Watches

Did you know there is a market for luxury watches?

There are people who collect high end watches and then resell them for a profit.

In some cases, people have been able to sell luxury watches for millions of dollars.

Like fine wine, you need to be aware of what you are buying and make sure it is in good condition.

You also need to be aware that some watches are more valuable than others.

For example, a Rolex watch is worth a lot more than a Timex watch.

Finally, you have to be able to spot counterfeit watches.

The last thing you want to do is invest thousands of dollars into a watch that is a fake.

Because of this, you should only invest in this market if you are passionate about watches and can spot the little things that make them unique.

Average Return To Expect

Just like with other investments, the return you get will depend on what you buy and how well it has been taken care of.

However, you can expect a return of 50% or more on a luxury watch.

#13. Handbags

Another of the unusual investments is handbags.

Many people collect high end bags and then resell them for a profit.

In some cases, people have been able to sell handbags for thousands of dollars.

Just like with other luxury items, you need to be aware of what you are buying and make sure it is in good condition.

You also need to be aware that some hand bags are more valuable than others.

For example, a Chanel bag is worth a lot more than a Coach bag.

And like luxury watches, you also need to know that there are a lot of counterfeit bags out there.

What makes this investment tricky is the fake bags are getting close to impossible to spot.

There are many reports of the fake bags being made in the same factories as the real bags.

How is this possible?

Since manufacturing is moving overseas, the factories will produce a hand bag, then produce a few hundred more that they sell for a lower price.

The last thing you want to do is invest in a knock-off handbag.

Average Return To Expect

Right now, this investment is hot.

As a result, you can see returns of 50% or more.

But just a few years ago, you would be looking at a 20% return.

Needless to say, there is money to be made by investing in hand bags.

#14. Sneakers

One of the biggest crazes right now is sneakers.

There is even an event, SneakerCon, where you can buy, sell, and trade sneakers.

But if you are looking for one of the best ways to invest outside the stock market, this could be it.

There are limited release sneakers hitting the market all the time that buyers snatch up to resell.

Combine the limited supply with the hyped up demand and you have serious investing returns.

But because the sneakers are released online, you are competing with buyers around the world.

Average Return To Expect

For high end limited edition sneakers, you can earn upwards of 2,000% on your money.

That isn’t a typo.

The problem is being lucky enough to get your hands on a pair during the release.

For other sneakers, you can earn 100% or more on your investment.

#15. Cannabis

As marijuana and CBD become more mainstream and widely accepted, cannabis demand will only increase.

So how do you invest in this crop?

Some states have legalized the growing of the crop, so if you are a state that allows this, having a farm is a way to earn a serious amount of money.

If you don’t live in one of these states, the easiest route for you is to invest in cannabis companies that are traded on the stock market.

A number of companies are publicly traded, you just have to do your homework to find the ones that meet your investment objectives.

Average Return To Expect

If you can invest in a farm, you will see the highest possible return, easily over 20% annually.

If you decide to invest in these stocks, you could see an 8% return.

However, understand that these stocks are very risky.

If a country keeps marijuana a crime, the stocks won’t return as much.

But if countries begin to legalize it, these stocks could take off.

#16. Equity Crowdfunding Real Estate

In the past, if you wanted to try real estate investing, you needed to buy out rental properties.

Not only was this a lot of work, but you needed a lot of money too.

Thanks to technology, there is a new way to invest in real estate.

Crowdfunding.

Here, a group of investors pool their money together to invest in a property.

This allows you to get started in the real estate industry with small amounts of money.

They then earn a monthly income based on their ownership percent.

And when the property sells, they earn a share of the capital gain as well.

There are a couple of businesses that help you get started with crowdfunded real estate.

The first is Arrived Homes.

They allow you to pick the exact residential properties you want to invest in and you can invest with as little as $100.

It’s a great option for new real estate investors to get started.

Another option is Diversyfund.

The main difference is you don’t have control over what you invest in.

Diversyfund picks the properties, both residential and commercial properties, and you sit back and earn a passive income.

Average Return To Expect

With real estate in general, you are looking at an average annual return of 10%.

If the property sells for a gain, this return will be in addition to the 10% return.

#17. Farmland

If you are looking for another stable investment, farmland could be a good option.

In the past, farmland was seen as a safe investment because people always need to eat.

And with population growth and the rise of the middle class in developing countries, that still holds true today.

This is what has led to an increase in prices for farmland.

In the past, you could pick up a farm for $100 an acre.

Now, that same farm would cost you $1,000 or more per acre.

But don’t let that scare you away from this investment.

The prices are only going to continue to increase as the population grows and the need for food increases.

How do you get started?

There are companies out there that allow you to invest in farmland, like FarmTogether and AcreTrader.

Average Return To Expect

The return you can expect when investing in farmland varies.

However, on average, you can expect to earn between 6-10% on your money.

The good news is if you invest with the sites mentioned above, they will give you their projected return and time horizon before you invest, so you know what to expect.

#18. Burial plots

One strange investment is burial plots.

People have been investing in them for centuries because they are a safe investment and come with a guaranteed return.

How it works is you buy the plot upfront and then resell it to someone who is interested in being buried in that location.

Since we can’t create more land, the price of the plot usually goes up over time, so you can make a nice profit on your investment.

The upside with this investment is the Baby Boomer generation is now retiring and will be passing away soon.

This is could lead to an increase in the demand for burial plots.

On the flip side, if these people choose to not be buried, the demand dries up and along with it, the return you can achieve.

Average Return To Expect

On average, you can expect to earn an annual return of 12-15% on your investment in burial plots.

#19. Tax Liens

When a property owner doesn’t pay their taxes, the government can place a lien on the property.

This is basically a claim against the property until the taxes are paid.

In some cases, if the owner still doesn’t pay, the government will auction off the lien to investors.

This is where you come in.

You can buy the lien for a fraction of what the property is worth and then wait for the owner to pay you off.

If they don’t, you can foreclose on the property and take it yourself.

It’s a risky investment, but if done correctly, can be very profitable.

Average Return To Expect

The average return you can expect from a tax lien investment is 16%.

However, there is no guarantee you will make this return.

It all depends on how long it takes for the owner to pay off the lien and whether or not you foreclose on the property.

#20. Private Mortgages

If buying burial plots or crowdfunded real estate doesn’t interest you, and you have a decent amount of cash, you can invest your money in private mortgages.

With this investment, you are essentially loaning someone money to buy a property.

They will then pay you back with interest over a set period of time.

In other words, you act as the bank offering a loan.

This can be a riskier investment, but if done correctly, can offer high returns.

Average Return To Expect

On average, you can expect to earn a return of 12-15% on your investment in private mortgages.

The reason for the high return is you are taking on all the risk and in most cases, you are dealing with people with below average credit scores.

Once again, this is not a guaranteed return and depends on the success of the borrower’s purchase and their ability to repay the loan.

#21. Bank Accounts

You could make the argument that opening bank accounts is not really an investment.

But since many banks offer generous sign up bonuses, it is a safe way to earn a decent return.

In fact, some banks offer bonuses as high as $200.

All you have to do is open a checking and/or savings account and keep a minimum balance.

In some cases, you may need to set up a direct deposit or use your debit card a certain number of times a month.

Then, after a few months, the bank will deposit the bonus into your account.

It’s not going to make you rich, but it’s an easy way to make some extra money without too much effort.

Average Return To Expect

You can expect to earn an average return of $100 from bank account bonuses.

And seeing as how you can do this with a number of banks in a year, you could make $1,000 or more for not much work.

Again, this is not a huge return, but it’s passive income that you can get without doing too much work.

#22. Credit Cards

If opening bank accounts doesn’t offer a high enough return for you, look no further than credit cards.

Opening new credit card accounts for the sign up bonus, also called churning, is very popular.

In fact, some people make a full-time living from it.

All you have to do is open a new account, meet the minimum spending requirements, and then close the account after you’ve received the bonus.

Repeat this process as many times as you want and watch your bank account grow.

While most credit card companies are OK with churning, many have redefined what is considered a new customer.

As a result, you can only take advantage of some of the bonuses every few years.

But don’t let this stop you.

If done strategically, you can still profit handsomely from this venture.

Average Return To Expect

On average, you can expect to earn a return of $500 from churning credit cards.

In some cases with travel reward credit cards, you can earn free flights or hotel stays just from the sign up bonus alone.

#23. Equipment Leasing

An outside the box investment is that of leasing equipment.

This is a great option if you have some money to invest.

It works by having you buy equipment and then leasing it, or renting it to businesses.

This equipment can be anything from office furniture to construction tools.

The beauty of this investment is that there is no long-term commitment required.

You simply lease the equipment for a set amount of time and then it is returned to you.

Average Return To Expect

When you lease equipment, you can earn between 10-20%.

The amount you earn will depend on the type of equipment as some things will go for more than others.

#24. Small Businesses

Another option for those looking for a more hands-on investment is to invest in small businesses.

This can be done by either lending the business money or buying shares in the company.

One of the benefits of this type of investment is that you get to be involved with the company and see it grow.

On the downside, there is more risk involved.

This is especially true since many small businesses fail.

But if you do your homework, the potential rewards are high.

Average Return To Expect

When investing in a small business, you can expect to make a return of anywhere from 25-100%.

This number will vary depending on a number of factors such as the company’s financial stability and how good your investment is.

#25. Worthy Bonds

If the idea of investing in small businesses interests you but you don’t have the time or desire to find businesses to invest in, you can try Worthy Bonds.

This company loans small businesses money to fund their inventory.

Worthy charges interest on this loan and you as an investor earn a stable 5% on your money.

I’ve been investing with them for a few years now and it’s an easy way to safely earn above average returns on my money.

Best Way To Earn Passive Income

Worthy Financial

Looking to safely earn a higher return on your money? Worthy Bonds offers 5% 7% interest on your money. Invest in small businesses and earn a return for doing so. New users get a $10 bonus when purchase your first bond.

Get Started

Read My Review

We earn a commission if you make a purchase, at no additional cost to you.

Average Return To Expect

The return you get is 5% no matter what.

Compared to savings accounts that pay around 1%, it’s a great way to boost your returns on a safe investment.

Final Thoughts

As you can see, these are the best uncommon investments ideas to consider investing in.

It’s important to note these are not get rich-quick schemes, but actual ways to invest your money.

Each of them has the potential to earn you a high return on your investment.

But remember, with any investment, there is always risk involved.

Do your homework before investing and make sure you understand what you’re getting into.

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.

Read the full article here